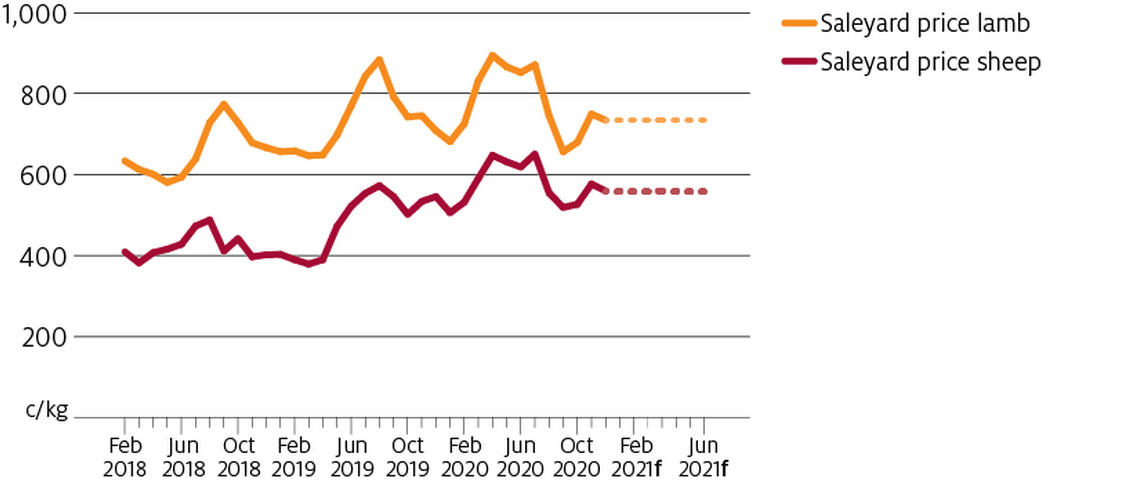

The average saleyard prices of lamb are forecast to fall in 2020–21 by 10% to 726 cents per kilogram and sheep by 5% to 555 cents per kilogram. Elevated demand for sheep meat due to African swine fever has dissipated, with COVID-19 reducing consumer willingness to pay internationally in 2020–21. Export demand has begun to recover from measures put in place to reduce the spread of COVID-19. However, the ongoing economic downturn will inhibit demand from reaching the pre-COVID-19 highs that saw the weighted average saleyard prices in 2019–20 for lamb reach 807 cents per kilogram and 584 cents per kilogram for sheep.

On the supply side, favourable seasonal conditions have provided an opportunity for producers to begin flock rebuilding. Stronger demand from producers as opposed to processors is highlighted by the widening gap between trade lamb and restocker/feeder lamb (up to 18 kg) prices. Joining decisions following the drought to increase the supply of lambs purely for meat production will limit the supply of lambs available for restocking. Similarly, the supply of mutton will be tight as producers retain breeding ewes for flock rebuilding. The falling supply of sheep will reduce the fall in the saleyard price of sheep relative to the saleyard price of lamb.

In 2020–21 the average price of lamb exports is forecast to fall by 9% to $8.76 per kilogram. Similarly, the average price of mutton exports is forecast to fall by 6% to $7.04 per kilogram. Lower international and domestic demand is anticipated in 2020–21 due to fading African swine fever induced demand and the negative effect on the global economy of measures to contain the spread of COVID-19 (see Economic overview). Lower consumption of sheep meat in Australian export markets is expected to continue to place downward pressure on export prices.

In 2020–21 mutton exports are forecast to fall by 33% to 123,000 tonnes shipped weight due to low flock numbers and retention of ewes. However, overall sheep meat exports are forecast to fall by only 9% to 418,000 tonnes, buffered by a 5% increase in lamb exports to 295,000 tonnes.

The export value of sheep meat is forecast to fall by 15% to $3.5 billion in 2020–21 as lower average export prices add to the fall in export volumes. The export value of mutton is forecast to fall by 36% to $866 million and the export value of lamb is forecast to fall by 4% to $2.6 billion.

Australian sheep meat exports stabilised in the third quarter of 2020, following consistent reductions in volume and value since the outbreak of COVID-19 in early 2020. The volume of lamb exported was 9% greater year-on-year in the third quarter of 2020, while the value of lamb exports was only 0.2% less than for the same period in 2019. Similarly, the volume of mutton exports was 25% less in the third quarter of 2020 relative to the same quarter in 2019, with the value of mutton exports down by 30%. Sheep meat export volumes fell to a trough in the second quarter of 2020 due to COVID-19 restrictions. In the third quarter of 2020 export volumes rose marginally. Export values for lamb and mutton fell more than export volumes due to lower export unit values.

COVID-19 offsets African swine fever

The spike in China's import demand generated by African swine fever has dissipated due to COVID-19 and faster recovery of the Chinese pig herd than previously anticipated. In the third quarter of 2020 the volume of lamb exports to China was 13% lower and mutton 32% lower than for the same period in 2019. Over this period export values to China fell by more – 37% lower for lamb and 38% for mutton – because the average price of exports fell.

In 2019 the volume and value of Australian sheep meat exports to China expanded as Chinese consumers sought to fill a protein gap created by reduced access to pig meat due to African swine fever. The surge in demand from China increased average prices for Australian lamb and mutton exports. Since the outbreak of COVID-19, Australian sheep meat which is largely consumed in the food service industry has contributed a smaller share to this protein gap. Furthermore, rebuilding of the Chinese pig herd has progressed faster than previously anticipated, however significant retention of sows for reproduction is limiting pork available for consumption. In 2020–21 exports to China have continued to fall, despite the protein gap still present in the market.

Australia (38%) and New Zealand (34%) account for the majority of world sheep meat exports and 97% of China's sheep meat imports were sourced from Australia and New Zealand in 2019. Australia accounted for 44% and New Zealand 53% of China's total sheep meat imports. Imports of sheep meat from New Zealand fell as steps were taken to control the pandemic in China – but these have since recovered. New Zealand's exports to China are cyclical in nature and their current low level is not pandemic-related. By contrast, since the outbreak of COVID-19 Australian exports to China have not returned to previous levels, possibly a result of Australia’s low supply of sheep meat.

Adaptation to COVID-19 saw the volume of lamb exported from Australia via airfreight increase by 57% in October 2020 from the lows in June 2020. In 2019–20, 83% of Australian sheep meat exports via airfreight were destined for the Middle East. Lamb comprised 91% of the sheep meat exported via airfreight, with lamb exported via airfreight to the Middle East increasing by 61% between June 2020 and October 2020.

Airfreight lamb to the Middle East fell drastically due to COVID-19, pulling down total lamb exports to the Middle East. Recovery of airfreight has seen an increase in lamb exports to the Middle East from July 2020.

Lamb production to rise and sheep production to fall

In 2020–21 Australian lamb slaughter is forecast to rise by 3% to 21 million head, due to favourable conditions in the latter half of 2019–20 and increased joining with terminal sires (those joined purely for meat production). This will limit promotion into the flock, with lamb production forecast to rise by 4% to 500,000 tonnes in 2020–21.

By contrast, in 2020–21 sheep slaughter is forecast to fall by 30% to 5.8 million head, with mutton production falling by 30% to 146,000 tonnes. This fall is forecast because of the expected retention of older ewes for flock rebuilding – compounding low national flock numbers following the drought.

The national flock is forecast to increase slightly year-on-year to 65 million head in 2020–21. The strong desire to restock and capitalise on favourable conditions is highlighted by the widening gap between trade lamb and restocker/feeder lamb prices at the beginning of 2020–21. Higher conception rates and pasture production will support the number and weight of lambs in 2020–21. However, most of these lambs are expected to be slaughtered for meat production – adding little to flock numbers.

The volume of live exports is forecast to fall by 11% to 950,000 head in 2020–21. The live export trade had a slow start to 2020–21, with volume down by 58% and value down by 57% on the same period in 2019–20. The Australian Government placed additional conditions on live sheep exports for the 2018 northern hemisphere summer and temporarily restricted live sheep exports from June to September 2019. This provided time for research and consultation into improved regulations to protect sheep from heat stress on these long voyages. The result was a new Australian Meat and Live-stock Industry (Prohibition of Export of Sheep by Sea to Middle East—Northern Summer) Order 2020 to regulate sheep exports to the Middle East between 1 May and 31 October each year.

Between February and April sheep meat exports from New Zealand to the EU fell sharply due to COVID-19 related lockdowns. On 28 October 2020 several EU countries entered a new COVID-19 related lockdown, therefore we can assume exports will follow a similar pattern during this lockdown period. In 2019 New Zealand was the largest exporter of sheep meat to the European Union, accounting for 21% of its total sheep meat exports. By contrast, only 1% of Australia's sheep meat exports were destined for the European Union. The proportion of NZ exports increases to 31% if the United Kingdom is included, and to 3% for Australia. New Zealand is therefore more exposed to potential COVID-19 related reductions in demand and could be forced to seek alternative markets in the short-term. This would increase competition between Australian and New Zealand sheep meat in international markets and place downward pressure on export unit values.

The need for a reliable and secure food source has become glaringly obvious during the COVID-19 pandemic. The European Union, the United States and various other producers of red meat are well behind Australia in controlling COVID-19, positioning Australia as a reliable producer of red meat. With consumers more aware of the source of their products Australia’s reputation as a reliable and secure source could become an increasingly important competitive advantage.

Lamb and sheep saleyard prices, February 2018 to June 2021