Courtesy of Meat & Livestock Australia and ABARES

The national flock is predicted to grow by 4.9 per cent to 74.4 million head in 2022, reaching its highest level since 2013, according to Meat & Livestock Australia’s (MLA) latest Sheep Industry Projections.

Continued strong seasonal conditions across key sheep producing states of New South Wales and Victoria, as well as a favourable autumn and winter rainfall for Western Australia in 2021 were the key drivers in boosting the flock’s growth in 2022.

MLA’s Market Information Manager, Stephen Bignell, said with continued strong domestic production conditions and slaughter volumes expected to increase significantly in 2022, the Australian sheepmeat industry had outperformed expectations.

“With an influx of lambs expected to hit the market in early to mid-2022, slaughter volumes are predicted to reach 21.6 million head in 2022 meanwhile sheep slaughter is expected to reach six million head in 2022, marking a 17.6 per cent increase on 2021 levels,” Mr Bignell said.

“Given the abundance of feed across the key lamb producing regions of eastern Australia during both 2020 and 2021, average national lamb carcase weights are expected to gain a modest 0.2kg to reach 25kg in 2022.

“Production is set to increase in the next few years to record levels. In 2023 it is predicted that production for lamb will be at an all-time high of 567,000 tonnes which will subsequently flow through to higher exports.

“Overall, Australia’s sheepmeat industry is positioned to strengthen, and confidence remains high across most parts of the industry, including the production end where seasonal conditions and overall historical market prices have never been more favourable.”

Mr Bignell said as the high-value Australia-UK- Free Trade Agreement (A-UK FTA) comes into effect later in 2022, the Australian sheepmeat industry was in a well-built position to further strengthen and capture global opportunities in both emerging and established markets.

“Australia will benefit from enhanced access to the UK market. This will include a tariff-free volume of 25,000 tonnes of sheepmeat in year one, increasing to 75,000 tonnes by year 10,” Mr Bignell said.

“Australia is likely to emerge as the only country with the production and transport infrastructure available to meet supply challenges over the next decade as well as ongoing demand from markets that lack the capacity for domestic supply.”

Flock

In 2021, the sheep flock was at its largest size since 2017 with a projected total of 70.9 million head. After years of drought induced turn-off, flock growth continues to increase steadily on the back of encouraging seasonal conditions. MLA forecasts that the national flock will reach 74.4 million in 2022, marking an 4.9 per cent increase on 2021 levels.

Slaughter

In 2021, lamb slaughter was predicted to reach 20.25 million head, approximately 350,000 head higher than 2020. Due to the large size of the 2021 lamb cohort MLA expect a promising influx of lambs to hit the market in early 2022, with lamb slaughter expected to reach 21.60 million head in 2022. Meanwhile, sheep slaughter is expected to reach six million head in 2022, marking a 17.6 per cent increase, or 900,000 head on 2021 levels. These projections for higher sheep slaughter represent the maturation of the Australian sheep flock rebuild and

follows consecutive years where older ewes have been retained on-farm. COVID continues to challenge the processing sector. If unresolved, labour shortages could significantly affect Australian abattoirs and reduce slaughter capacity at a traditionally critical time of year for lamb processing

Carcase weights

MLA isn’t forecasting significant changes to carcase weights in 2022. Given the abundance of feed across the key lamb producing regions of eastern Australia during both 2020 and

2021, average national lamb carcase weights are expected to gain a modest 0.2kg to reach 25kg in 2022. Price premiums for trade and heavy weight lambs continue to provide producers with an incentive to add additional kilos to animals.

Shearing

Over the last two installments of MLA and AWI’s Wool and Sheepmeat survey, the percentage of Merino breeding ewes has fallen from 76 per cent to 72 per cent, highlighting a move away from wool production to meat production. This move towards meat production can be attributed to several factors including lower wool returns, higher lamb prices and difficulties in sourcing

Shearers. The difficulty in sourcing shearing staff is a result of increasing shearing rates in New Zealand, which has reduced the number of NZ shearers who choose to work in Australia. The shearer shortage has led many producers to extend the period between shearings, sometimes to two shearings every three years. Additionally, some producers are paying above the standard rate to secure shearers – putting upward pressure on shearing costs. In the last three years since February 2019, the EMI (Eastern Market Indicator) which measures wool price performance has fallen by 28 per cent, from 1,934¢/kg back to 1,389. In the corresponding period, the National Trade Lamb Indicator has increased by 30 per cent to 865¢/kg.

Labour shortages

In 2022, labour shortages are expected to be an area of significant concern for the red meat industry right across the entire supply chain. The shortages that industry will face will affect the availability of farm hands and managers, through to boning room staff in processing plants as well as truck drivers. The impacts of a labour shortage on the processing sector are difficult to forecast or quantify. However, securing more staff through skilled and non-skilled visa programs will be critical to ensure reliable supply to both the domestic and international markets of Australian sheepmeat. New government visa programs are a welcome development and should provide red meat businesses with access to a larger employee pool.

Global supply chain disruption

Supply chains and logistics are a major hurdle for the sheepmeat industry in 2022 and 2023. The issue covers both the difficulty in getting product to the desired market and the cost of freight. Ongoing disruption, initially stemming from COVID-19, has seen continued delays and large price increases in shipping routes globally. Shipping costs worldwide have increased by 434 per cent in 2021, with many ships initially earmarked for smaller routes redirected to larger ones, while shipping companies rapidly raise prices and change schedules to meet market conditions. Locally, this has been felt through higher prices, greater uncertainty and delivery delays.

Domestic demand for sheepmeat

With uncertainties and trade tensions in the international markets, the importance of the domestic market is increasing. Localising more of the Australian meat consumption lowers the impact of supply disruptions associated with international events. Lamb consumption in Australia makes up a large proportion of total global lamb consumption. However, the domestic

utilisation of lamb has been gradually dropping since 2015. Australia domestically consumed 60,645 tonnes of lamb in the March quarter of 2015, falling to 39,751 tonnes in the September quarter of 2021. The quarterly utilisation has cumulatively dropped by 34per cent, whereas the retail price has increased 40 per cent over the same period, trending upwards from $13.29/kg to $18.59/kg. The sales volume of lamb shows strong resilience to the price movement in Australia’s domestic meat sector. In 2021, the retail price of lamb remained relatively stable. Compared to the 11 per cent growth of the beef and veal retail prices, the quarter-on-quarter increase for the lamb price in the September quarter of 2021 was less than 1 per cent. Meanwhile, chicken and pork saw a decline of 0.4 per cent. The relative price change among the major proteins suggests consumers are shifting their consumption towards cheaper meats.

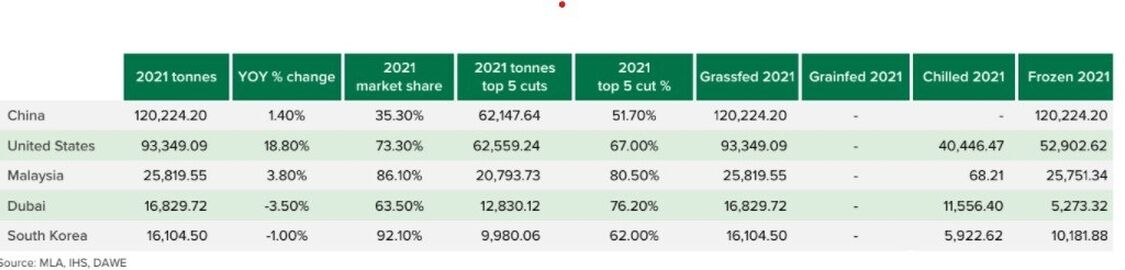

Global markets summary

2021 saw over one million tonnes of sheepmeat exported globally, down 6.1 per cent on 2020 volumes. Australia was the largest exporter, followed by New Zealand and the UK, which shipped 62,000 tonnes. China remained the largest import market for sheepmeat at 372,000 tonnes, followed by the US, which imported over 115,000 tonnes, and the UK, at 43,000 tonnes

(Source: IHS Markit). In Australia, overall sheepmeat exports increased by 0.5%. At the same time, the overall value of sheepmeat exports rose by 5.3 oer cent to $3.96 billion. This reflected a strong increase in the unit value of sheepmeat products from Australia, with each unit

of sheepmeat valued at $9.05/kilogram compared to $8.54/kg in 2020. The volume of chilled sheepmeat exports dropped by 12.2 per cent, while frozen exports increased in 2021 by 4.9 per cent. Lamb represented 65.3 per cent of total exports, while mutton accounted for 34.7 per cent Exports into the US increased by 18.7 per cent in 2021, to 93,349 tonnes. Of this, chilled lamb accounted for 43.3 per cent, frozen lamb accounted for 32.3 per cent and frozen mutton accounted for the remaining 24.4 per cent. Over the decade, Australian sheepmeat exports are projected to increase by 20 per cent to 488,000 tonnes per annum in 2031 (Source: OECD/FAO).

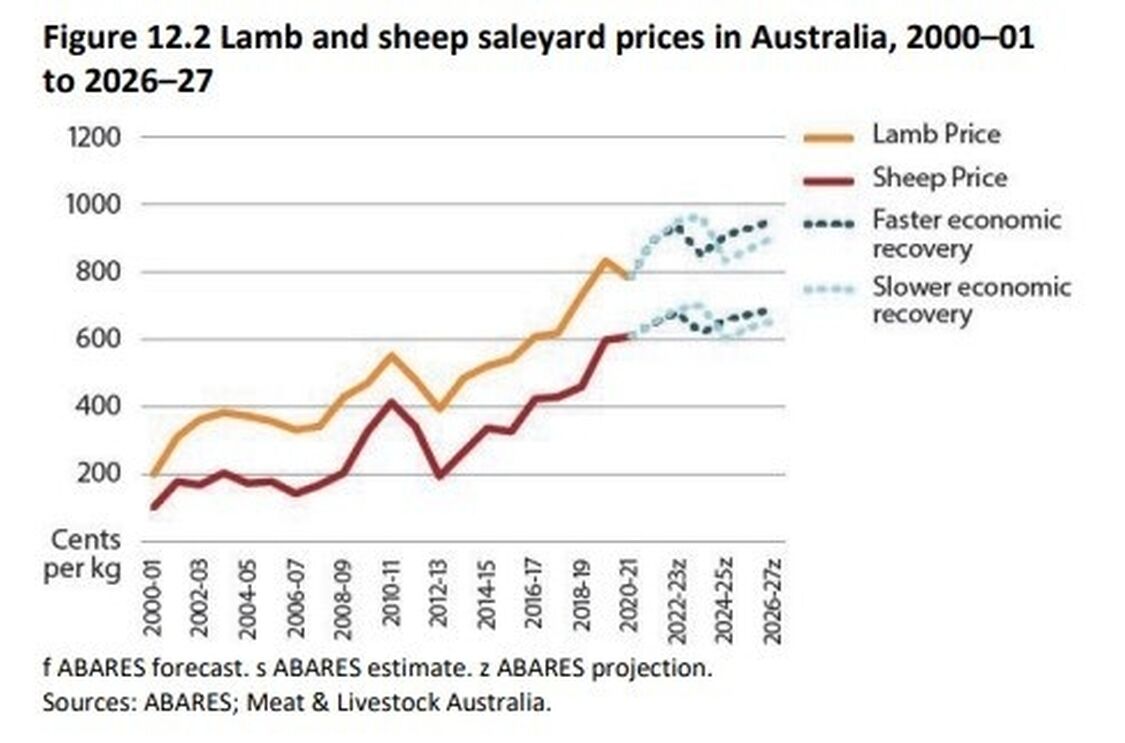

Price

The 2022 saleyard prices for sheepmeat categories have been mixed, however they are outperforming the long-term historical averages. In 2021–22, lamb saleyard prices are expected to increase 14 per cent to 893 cents per kg, whilst sheep saleyard prices are expected to rise 7 per cent to 648 cents per kg. Lamb prices in the current financial year have been supported by

strong export demand from the United States. Lamb and sheep prices are expected to rise over the short-term to 2022–23 due to strong export demand in the United States. If the pace of the global economic recovery is slow, prices are expected to continue increasing until 2023–24, as higher global inflation supports global demand for sheep meat. However, over the medium term to 2026–27, domestic lamb and sheep prices will also be influenced by seasonal conditions. Although the timing of a dry year is uncertain, the occurrence of drought-like conditions is expected to weigh on saleyard prices in both scenarios.

Value

The gross value of production of the sheep meat industry is forecast to break a new record of over $5 billion in 2021–22, supported by record high prices and rising sheep meat production.

Global inflation is expected to ease by the middle of 2022 and global incomes are expected to rise. As a result, lamb prices are expected to rise by 5%, averaging 934 cents per kg in 2022–23. Sheep prices are expected to average 678 cents per kg in the same year. Prices could rise more quickly if global inflation remains high. In this scenario, inflation is expected to come down in 2024–25. This longer period of inflation would support sheep meat prices in the short term to 2023–24 but weigh on prices over the medium term to 2026–27. By 2026–27, the value of the sheep meat industry is expected to range between $5.6 billion and $6.1 billion depending on the path of global economic recovery (Figure 12.1).The value of Australian sheep meat exports is forecast to reach $4.4 billion in 2021–22. This is being driven by strong sheep meat exports to the United States. By 2026–27, dependent on the scenario, the value of exports is expected to be between $4.6 billion and $5.1 billion. In the slower economic recovery scenario, meat prices in the US are expected to continue rising faster than general inflation over the next two years.