Courtesy of ABARES

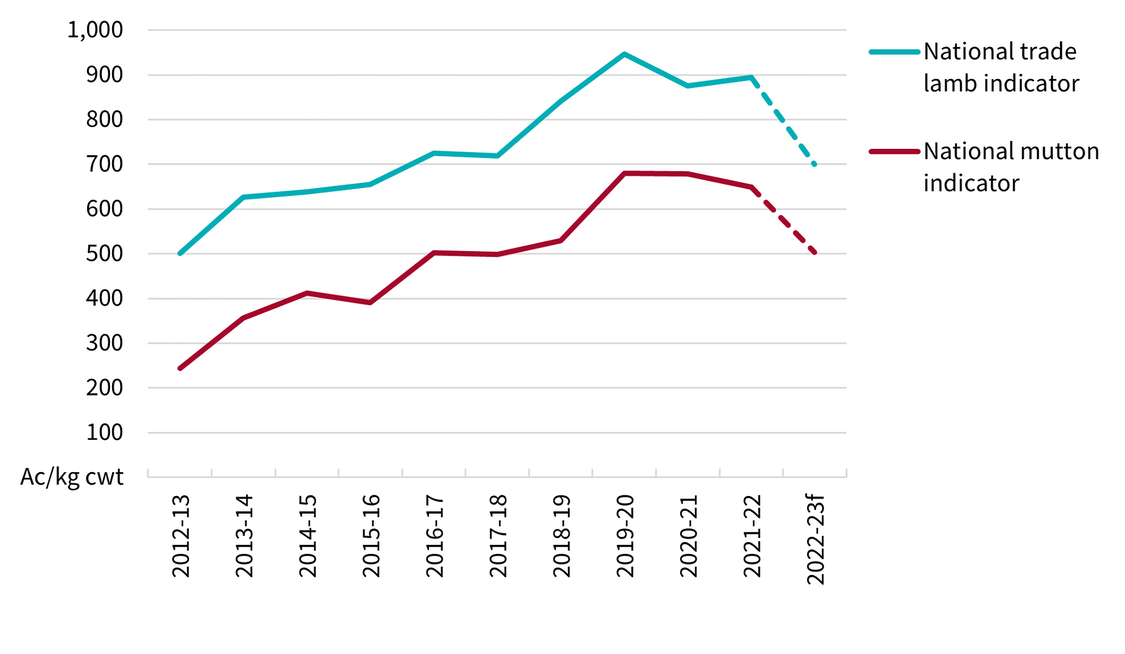

Sheep saleyard prices forecast to fall but remain historically high.

Saleyard demand from processors to remain strong but farm purchases of restocking animals to fall.

Favourable seasonal conditions continuing to support producers' intentions for finishing lambs quickly.

In 2022–23, the value of Australian sheep meat production is forecast to fall by 7% to $4.4 billion due to falling saleyard prices. Strong international demand for Australian sheep meat is expected to sustain high saleyard demand for finished animals, but demand from graziers for restocking animals is expected to fall. The supply of sheep and finished lambs in saleyards is expected to further increase, supported by higher numbers of ewes mated in the first half of 2022 and continuing favourable growing conditions over spring, as forecast by the Bureau of Meteorology.

The value of Australian sheep meat exports in 2022–23 is forecast to fall by 3% to $4.4 billion, due to falling lamb and mutton prices offsetting an overall increase in export volumes. Export prices are expected to fall from record levels reached in 2021–22 although remain high, supported by continuing strong demand from the United States and China. Constrained supply of sheep meat from New Zealand due to unfavourable spring and summer conditions is also expected to support Australian exports.

In the United States, retail prices of meat are expected to remain elevated due to the high input costs confronting US meat supply chains, including the costs of feed grains, energy, and labour. This will continue to support the price competitiveness of imported meat products in the United States and flow through to benefit Australian exporters.

In China, demand for imported sheep meat is expected to fall. Slowing economic growth is expected to drag on household spending and cause consumers to be more price conscious on expensive purchases such as sheep meat. Dry conditions in China's northwest provinces are also likely to result in destocking of sheep that result in a short-term increase in China's domestic sheep meat production. The share of imported meat in overall consumption is also expected to fall due to the greater availability and cheaper prices of pork in China. This comes as the Chinese pig industry continues to improve on containing outbreaks of African Swine Fever. Domestic consolidations and vertical integrations are providing further productivity benefits along Chinese pork value chains. The expected increase in Chinese pork production will be limited by the high cost of feed grains in the short term. However, the Chinese Government is diversifying its import sources with the aim of lowering the cost for their domestic industries over the longer term, including taking steps to review protocols for importing corn from Brazil.

The saleyard price of sheep in 2022–23 is forecast to decrease by 17% to 503c/kg largely due to a fall in restocking demand. This comes as two consecutive years of flock rebuilding in the eastern states have contributed to a higher population of ewes on farms and reduced the need for most producers to purchase from saleyards. Demand for finished sheep from processors is expected to remain consistent due to strong export returns, but overall slaughter will likely be capped by constrained labour availability and high energy-related processing costs confronting abattoirs. There will also likely be limits to sheep turnoff on farms as producers continue to rebuild their core flock and place priority on finishing lambs quickly.

The saleyard price of lamb is forecast to fall by 16% in 2022–23 to average 700c/kg because more finished lambs are expected to be sold. Ample availability of pastures during autumn of 2022 has maintained high joining rates based off a higher population of ewes rebuilt over the last two years. In addition, favourable seasonal conditions expected over spring will further sustain high pasture growth in grazing regions. These factors are contributing to forecasts of high lambing rates and marking rates which will boost the lamb crop this season. The low costs of finishing a lamb and further strong demand from processors are expected to see an increasing supply of trade lambs in saleyards.

High inflation in the United States and slowing economic growth in China cast greater uncertainty over international demand for Australian sheep meat exports in the short term. These downside risks could quickly translate to reduced saleyard demand for finished animals, placing further downward pressures on sheep and lamb prices.

On the other hand, an easing of lockdowns in China could provide some temporary increases in international demand as restaurants re-open and eating out increases in the country. The confidence of Chinese consumers affected by the containment of COVID-19 and unfolding economic prospects will be important for determining their spending decisions.