WHILE the future impacts of the current Covid-19 pandemic on all agriculture commodities is still unknown, sheep and lamb prices have started the year off historically strong.

In the second week of March, Meat and Livestock Australia’s Eastern States Trade Lamb Indicator reached a record high of 962c/kg, and sat at 941c/kg towards the end of that month.

MLA has not been reporting its usual ESTLI since then because of restrictions on its marketing coverage.

Rabobank Australia’s April Agribusiness Monthly shows all sheepmeat and lambs prices as above last year’s levels as well as higher than the 5-year-average, however it did predict a downward trend as we headed into the second half of April.

As of April 15, MLA’s revised Processor Lamb CV19 indicator sat at 943c/kg, with its Restocker Lamb CV19 at 720c/kg.

The figures are not directly comparable because of the altered CV19 indicators being currently produced by MLA, but as a point of reference, on the same day last year, the ESTLI was 715c/kg, with restocker lambs trading at 696c/kg.

Saleyard numbers jumped throughout March, which has put downward pressure on lamb prices, but MLA says “more useful rainfall and murmurs of recovery in China” have seen yardings ease.

“In recent weeks, producers opted to offload stock and take advantage of the high prices on offer, driven by growing market uncertainty,”MLA reported.

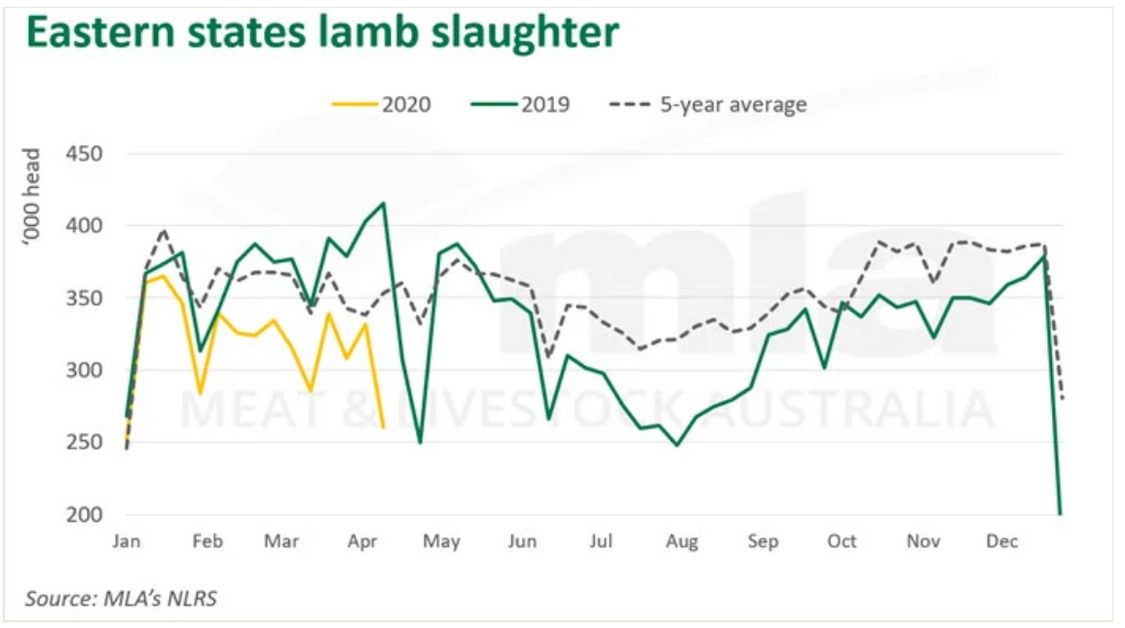

“The winter months were already shaping up to see reduced processor throughput, as a result of the poor conditions that prevailed in 2019.

“However, the recent spike in saleyard throughput suggests the contraction could be amplified through winter. Should this align with an improved global economic outlook, there would be scope for lamb prices to move higher.”

The rain-fuelled drop in slaughter, as well as CV19 created trade disruptions, pushed mutton exports 15 per cent lower year-on-year in February, according to Rabobank.

“While there were large increases in volumes to the US (up 39 per cent), volumes to China dropped 63 per cent,” the Rabobank April update said.

“Lamb exports were down 3 per cent year-on-year in February with the Middle East dropping 23 per cent.

“Lower oil prices and slower economic conditions are likely to have a large impact on Australian exports of lamb, given its premium positioning and as its key markets are the Middle East, the US, and China.”

MLA reported lamb exports were 5 per cent lower year-on-year for March, but were still at their highest volumes since October last year.

“Importantly, the resurgence of China supported exports as their foodservice industry regains some life,” MLA said.

“Global lamb prices are likely to come under some pressure over the next year, as the premium priced protein is challenged by the emerging tough economic conditions around the globe. “Lower oil prices and air-freight disruption could potentially undermine demand out of the Middle East.

“Australian lamb, which often captures premium positioning in high-end foodservice in many markets, is feeling the impact of restaurant closures.

“Growing demand outside the foodservice channel in many markets, and a demand bounce-back in China, will be critical for sheep meat in the coming months.”

ABARES March 2020 outlook for sheep and lamb said in 2019–20 the national sheep flock is expected to contract to a 115-year low, as “dry seasonal conditions and high saleyard prices provide an incentive to maintain high rates of turn-off”.

“The ratio of ewes in the national flock has strongly increased since 2012–13. This is a result of high lamb prices and dry seasonal conditions providing an incentive to turn off non-breeding stock.

“The high proportion of ewes in the national flock will help to maintain lamb turn-off if prices remain high, and accelerate flock rebuilding when demand eases and seasonal conditions improve.

“An end to drought conditions is likely to enable flock rebuilding, but high prices are expected to encourage high rates of turn-off.”

The CV19 pandemic has hit exports to China in the short-term, but ABARES points to competition from New Zealand and the US as future challenges.

“Competition from New Zealand in China is likely to increase because high prices provide an incentive for flock rebuilding and increased lamb production.

“Australia's national flock is significantly larger than New Zealand's, but New Zealand's flock productivity (measured in lamb production per ewe) is significantly higher because of the greater prevalence of meat breeds and a more favourable climate for pasture growth.

“Any expansion of the New Zealand sheep flock is likely to remain constrained by the profitability of dairy production.”